-

Feb 4, 2011It’s no secret that most of the organized governments in the world are essentially broke. The current debt to GDP ratio in the United States is almost 100%, a fairly incredible number that continues to rise. That number alone indicates that the US is in poor financial shape, and it’s not even that accurate a number. For example, the US has a number of off budget items that are technically debt as well – all the Freddy May and Fannie Mac purchases, Social Security (the US has been taking the money every year and basically putting an IOU in its place) and Medicare. If you factor in all of those ...read more: The Impending Debt Crisis

Feb 4, 2011It’s no secret that most of the organized governments in the world are essentially broke. The current debt to GDP ratio in the United States is almost 100%, a fairly incredible number that continues to rise. That number alone indicates that the US is in poor financial shape, and it’s not even that accurate a number. For example, the US has a number of off budget items that are technically debt as well – all the Freddy May and Fannie Mac purchases, Social Security (the US has been taking the money every year and basically putting an IOU in its place) and Medicare. If you factor in all of those ...read more: The Impending Debt Crisis -

Jan 24, 2011I have a lot to write about this week, but was in front of the computer so I recorded another quick and dirty video regarding the weekend. Enjoy. Video Update 2: Thoughts on Montevideo from Duane Storey on Vimeo. ...read more: Video Update 2: Thoughts on Montevideo and the Peso

-

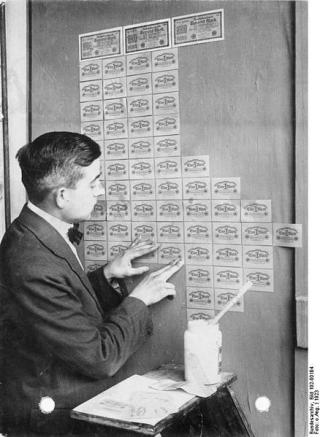

Dec 29, 2010Inflation is technically an expansion of the monetary supply. Prior to the invention of fiat (i.e. paper) money, inflation occurred when pure gold or silver coins were melted down and mixed with less valuable metals. The end result was a coin that was worth less, even though it was the same size, shape and colour. Another form of inflation occurred when people used to subtlety shave the edges of coins off and use that metal to purchase other items. The coins ended up becoming deformed, and had less metal than the used to have, making them worth less. With fiat money, inflation occurs when a country ...read more: The Real Inflation Rate

Dec 29, 2010Inflation is technically an expansion of the monetary supply. Prior to the invention of fiat (i.e. paper) money, inflation occurred when pure gold or silver coins were melted down and mixed with less valuable metals. The end result was a coin that was worth less, even though it was the same size, shape and colour. Another form of inflation occurred when people used to subtlety shave the edges of coins off and use that metal to purchase other items. The coins ended up becoming deformed, and had less metal than the used to have, making them worth less. With fiat money, inflation occurs when a country ...read more: The Real Inflation Rate -

Dec 15, 2010Yesterday the Canadian government alluded to a plan to completely remove the penny from circulation in the next 12 months. Their main motivation for this change is cost – the currently cost of a penny is around 1.5 cents, but the value of the coin is only 1.0 cent. So, the government would like to get rid of the penny. Now what does that mean for the average person? To be honest, not a whole lot in my opinion. First, retailers are supposed to round the final values to the nearest 5 cent value. If the item is less than 2.5 cents away from a lower price, retailers are supposed to round down. If ...read more: The Great Canadian Penny Massacre

Dec 15, 2010Yesterday the Canadian government alluded to a plan to completely remove the penny from circulation in the next 12 months. Their main motivation for this change is cost – the currently cost of a penny is around 1.5 cents, but the value of the coin is only 1.0 cent. So, the government would like to get rid of the penny. Now what does that mean for the average person? To be honest, not a whole lot in my opinion. First, retailers are supposed to round the final values to the nearest 5 cent value. If the item is less than 2.5 cents away from a lower price, retailers are supposed to round down. If ...read more: The Great Canadian Penny Massacre -

Nov 25, 2010There are various statistics used to track each country’s currency in circulation. The main ones that most people reference are the following: M0: The total of all physical currency, plus accounts at the central bank that can be exchanged for physical currency. M1: The total of all physical currency part of bank reserves + the amount in demand accounts (“checking” or “current” accounts). M2: M1 + most savings accounts, money market accounts, retail money market mutual funds,and small denomination time deposits (certificates of deposit of under $100,000). M3: M2 + all other CDs (large time deposits, ...read more: Money Supply And Inflation

-

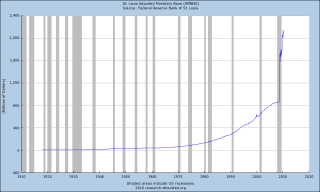

Aug 26, 2010The following graph formed the basis for Glenn Beck’s video talking about hyperinflation, but I thought I would repost it here. Inflation, by definition, is the expansion of the monetary base in a country. While conventionally most people associate rising prices (as measured by the consumer price index – CPI) as inflation, that’s just the symptom of inflation — the root cause in the expansion of the monetary supply. Most people concede that price increases tend to lag inflation by a year or two. So any inflation of the money supply today probably won’t be felt in terms of prices for another year ...read more: An Inconvenient Hockey Stick

Aug 26, 2010The following graph formed the basis for Glenn Beck’s video talking about hyperinflation, but I thought I would repost it here. Inflation, by definition, is the expansion of the monetary base in a country. While conventionally most people associate rising prices (as measured by the consumer price index – CPI) as inflation, that’s just the symptom of inflation — the root cause in the expansion of the monetary supply. Most people concede that price increases tend to lag inflation by a year or two. So any inflation of the money supply today probably won’t be felt in terms of prices for another year ...read more: An Inconvenient Hockey Stick